For Attorneys

Utilize the world's most powerful analysis and evaluation tool for FinCEN Beneficial Ownership Information reporting compliance. It helps extract the right information from clients, and produces an analysis that needs to be reviewed by an attorney.

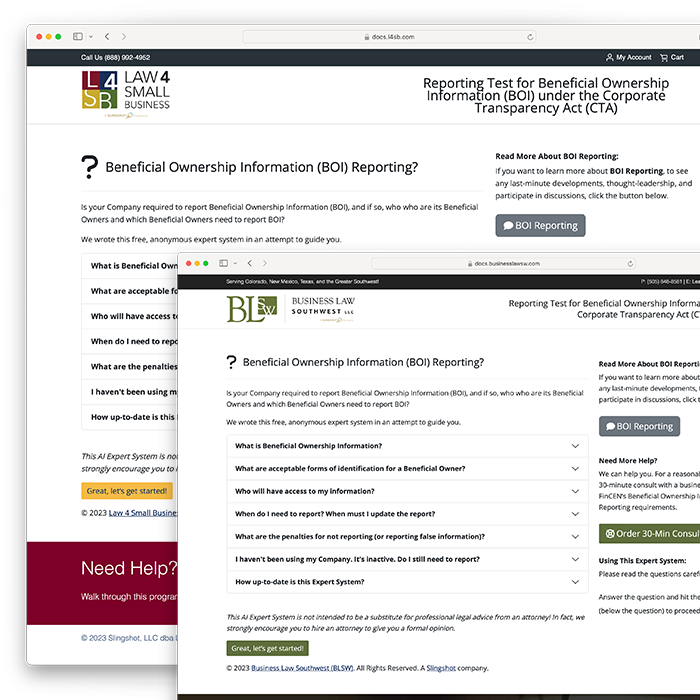

Aside from matching your firm's branding, the program can send clients to your website for more information, as well as the call-to-actions on the final analysis screen.

Our Feature Set & Value-Add

Let's face it, it's not too difficult to answer these questions with simple setups and company configurations. It becomes much harder when the company is not setup properly, or the client sits on edge-cases. BOI-Labs helps identify the edge-cases, and greatly reduce the time associated with BOI Compliance.

Our expert system supports from 0 to 10 classes, with up to 4 subclasses. The classes are independently evaluates, per FinCEN guidelines, and work appropriately no matter how company ownership is maintained (i.e. discrete shares/units versus percentage ownership). The system determines the appropriate evaluation method to use, based on the structure of the company.

FinCEN has done a great job spelling out the issues, providing flow-carts, and identifying edge cases. We wrote our expert system to be tightly coupled FinCEN's approach. Our questions and assessment can be verified side-by-side with the Small Entity Compliance Guide, reducing errors and headaches.

While we cannot promise to always have the system updated within 48-hours of a FinCEN change, we will try our hardest. It's important to have a system we can rely on, without having to second-guess whether the system is not just producing an accurate result, but that it supports the latest rules, regulations and interpretations coming from FinCEN.

Direct ownership is easy, but indirect ownership can be challenging and confusing. For example, the direct ownership of a company always totals to 100%, but there is no such limitation for indirect ownership. Our expert system does its best to identify these issues, and explain them. It also supports future ownership interest, as required by FinCEN.

Types of entities, tax status, ownership, classes and more, can be very confusing, even for the most learned lawyer, let alone business leaders. Therefore, our expert system does its best to help instruct, guide, flag problems, issue warnings, and double-check answers. There are over 100 ways the system stops itself, and recommends attorney review.

As Lawyers Who Code, we've been there and done that. As corporate lawyers with decades of experience, we've seen instances over and again, where companies are simply not setup correctly. S-Corps with multiple classes. Ownership claimed to be at 0%. Percentage ownership interest and shares issued at the same time. Our expert system tries its best to accept such difficulties, flag them, and moves on.

Companies are setup in a variety of different ways, especially in today's world of Unlicensed Legal Providers who don't give a lot of advice to their clients on the right way to setup a company and its tax status. We wrote our expert system to be flexible and work with the variety of different ways a company can be setup and configured.

Participate in the Discussions

Latest news from our Blog

Have More Questions?

We're posting updated information all the time, and post many articles that do a deep-dive into the latest issues.

You can also post comments (moderated) in our blog, although the Discussions is a better area for Q&A.

We have a moderated Q&A Forum (called the Discussions). Anyone can submit a Question, although we only permit licensed attorneys and verified subject-matter experts to Answer questions. This helps ensure high-quality and professional responses.

Please contact us, and we'll be happy to discuss how BOI-Labs could be of help to you and your practice, and the costs behind customizing our services to mee the needs of your firm and your clients.